Debt is becoming a real problem.

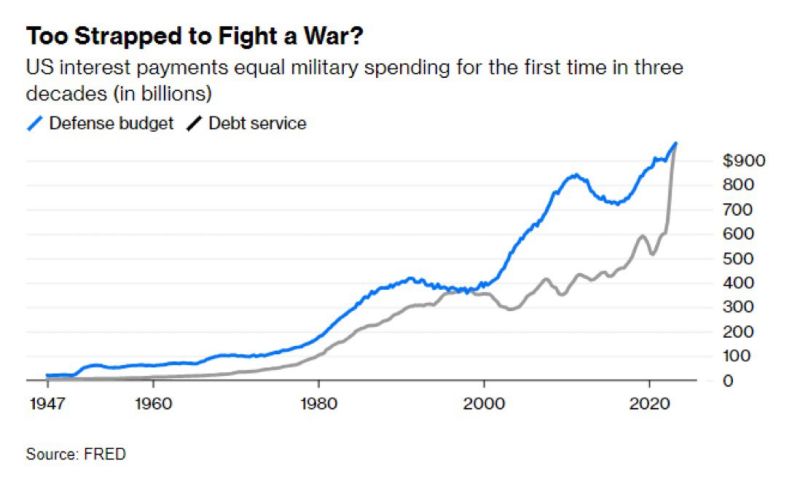

US interest payments just eclipsed defense as the biggest expense…

US national debt is about to hit $33 trillion.

It was *only* $31 trillion on October 2nd of last year.

That’s $2 trillion of additional debt in less than 12 months.

In fact, the debt seems to be piling up ever faster.

After America’s birth in 1776, it took 205 years to accumulate $1 trillion in sovereign debt – that was in 1981.

Now, it only takes 5 weeks…

With the debt ceiling no longer in effect, federal borrowing increased by over $1 trillion between June 2nd and July 6th. On June 3rd, the national debt jumped by more than $350 billion in a single day!

This is becoming expensive in today’s interest rate environment, with debt service now exceeding defense spending for the first time in 30 years.

The Congressional Budget Office projects that in 20 years the interest costs will be nearly three times the amount of spending on infrastructure, education, and R&D combined.

This is obviously unsustainable.

There’s an interesting study by the journal Science that estimates up to 50% of health care costs accrue during the patient’s final year of life. It’s over 80% of total spending for the last several years leading up to expiry.

This makes sense. The more terminally ill the system, the more expensive to maintain. Is it a coincidence then, that party leadership is over 80 years old?

Selling your own children into debt slavery, in order to eke out a few more miserable years of the status quo, is not the active of a loving parent.

What will happen once the system is necessarily taken off life support?