Title: You Can’t Taper a Ponzi Scheme: The FED Caught with Their Hand in the Cookie Jar

Introduction

The global financial system is a complex web of interconnected institutions, policies, and economic forces. Among these, central banks like the Federal Reserve (FED) play a pivotal role in shaping monetary policy and influencing economic stability. However, recent events have brought to light a disturbing revelation: the FED’s actions appear to resemble those of a Ponzi scheme, and their efforts to taper have consequences that ripple through the economy.

- The Tapering Conundrum

Tapering, in the context of the FED, refers to the reduction of its massive bond-buying program, initiated to stimulate the economy during times of crisis. The intention is to gradually scale back these purchases to normalize monetary policy. However, this process is not without its challenges and unintended consequences.

- Inflationary Pressures

One of the most significant issues with tapering is the potential for inflation to rise. When the FED raises interest rates or reduces bond purchases, it has a direct impact on the overall economy. One of the ways this occurs is through the inclusion of interest rate expenses in the Consumer Price Index (CPI).

As interest rates increase, the cost of borrowing rises for businesses and individuals. This, in turn, can lead to higher prices for goods and services, which is reflected in the CPI. Thus, the FED’s actions can inadvertently contribute to inflation, undermining its own efforts to control it.

- Interest Charges vs. Currency Measures

A crucial point to understand is that interest charges don’t exist as part of any currency measure; they are essentially a charge on top of the current money supply. Inflation targets and currency supply management can become an exercise in futility when interest rate expenses are a substantial part of CPI calculations.

- The Ponzi Scheme Analogy

A Ponzi scheme is a fraudulent investment scheme where returns to earlier investors are paid using the capital of new investors rather than actual profits. The scheme relies on a continuous influx of new investors to stay afloat, and when this flow slows or stops, it unravels.

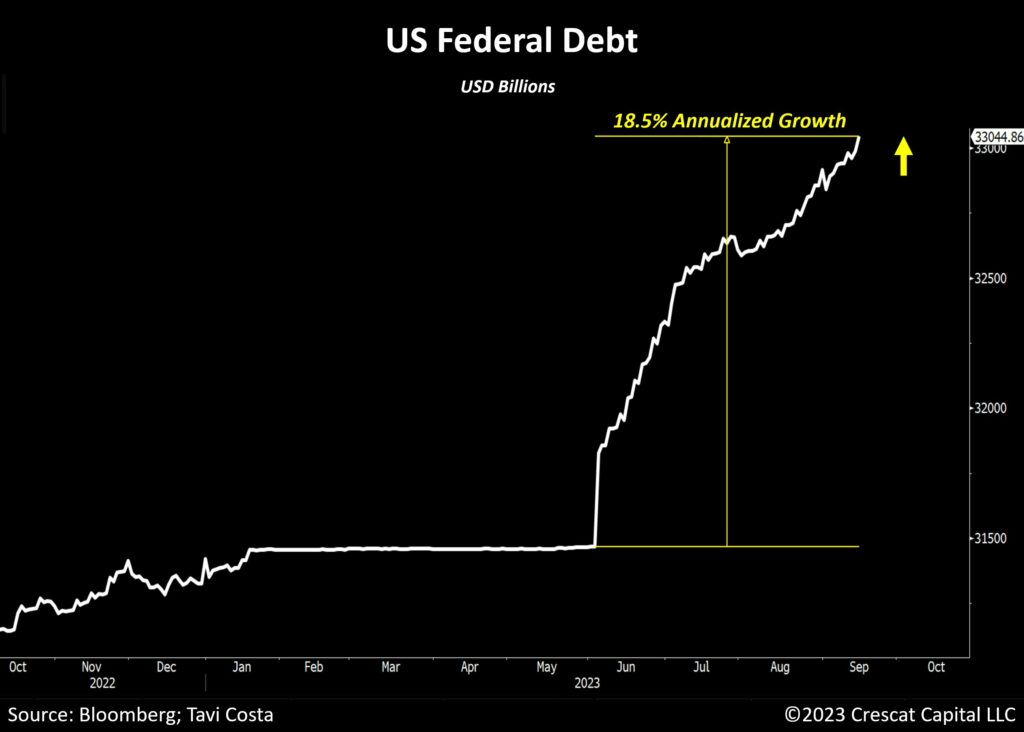

In a disturbing parallel, the FED’s monetary policy can be likened to a Ponzi scheme in one important aspect: it requires a continuous influx of new investors to maintain its stability. When default rates on loans and debts start piling up at an alarming rate, attracting new investors becomes increasingly difficult.

- Debt and Fiat Money Supply

The heart of the matter is that the FED’s actions could be inadvertently undermining the very foundation of the fiat monetary system. When debt deflates due to defaults and economic downturns, it creates a situation where fiat money supply is destroyed. This is the polar opposite of what a Ponzi scheme needs to survive.

- The Illusion of Paying Off Debt

One common misconception is that paying off the national debt would be a panacea for economic stability. However, this notion is erroneous because extinguishing all debt would simultaneously eliminate a significant portion of the fiat money supply. In the current system, debt and money creation are inextricably linked.

Conclusion

The economic truth is slowly being unveiled, and it raises questions about the sustainability of the current monetary system. The FED’s tapering efforts, while well-intentioned, may inadvertently resemble the workings of a Ponzi scheme. As inflationary pressures rise and the need for more investors to sustain the system becomes apparent, it’s crucial to rethink our approach to monetary policy and debt management to ensure long-term economic stability. The conversation around these issues should continue, as it’s essential for the well-being of our financial system and the future prosperity of our society.