“

US Bond ‘Glitch’

Yesterday morning, in what was called a ‘glitch’ US bond prices spiked. This happened during the Japanese market open and was later labelled a glitch, despite happening over a 3 hour window.

r/Wallstreetsilver – Unusual Events: Jets, Bonds, Gold, and the Fall of Rome

Some theories that have come to light

‘It was a glitch’

China (or someone) was selling down their bonds

Unwinding of Basis trades

We look at these theories below:

It was a glitch

The glitch coincided with an expiry of bond options, so some people are saying that this may have ‘caused a glitch’ in the data. Just to dispel this, the ‘glitch’ happened over 3 hours and happened over several bond denominations – 2Y, 5Y, and 10Y, though was most pronounced in the 2 year. It also happened, though less dramatically, in other bond markets like the Australian 2 Year which rose at the same time from 3.9% to 3.95% and has not seen the subsequent correction that occurred in the US. If it was a ‘data glitch’ why did it occur across so many markets and jurisdictions?

r/Wallstreetsilver – Unusual Events: Jets, Bonds, Gold, and the Fall of Rome

China (or someone else) were selling their bonds

One of the reasons you would see a spike in bonds yields is through the liquidation of bonds, i.e. selling them at a discount which has the opposite effect on yields, driving them higher. It has been fairly well documented that both Saudi Arabia have reduced their US treasury holdings from $184 billion down to $108 billion, and more dramatically China, reducing their holdings from $1.3 trillion to $800 billion. The recent tweets from The Kobeissi Letter show the dramatic sell down of US treasuries by some of these BRICS countries.

r/Wallstreetsilver – Unusual Events: Jets, Bonds, Gold, and the Fall of Rome

Interestingly, Yellen this morning at the Clinton Global Initiative sat with Hilary Clinton discussing, among other things, China-US relations. Yellen stated that ‘It would be disastrous for the US to decouple from China’ – could this be an indication that China is decoupling from the US through the sale of US bonds and oversized purchases of gold?

Bond basis trade

In a foreboding warning issued from the Federal Reserve researchers 5 day ago, they discussed possible ‘disruptions in US treasuries’ due to an oversized fund trading position that caused a similar bond market crash back in 2020. The article published by the Fed can be found here

https://www.federalreserve.gov/econres/notes/feds-notes/hedge-fund-treasury-exposures-repo-and-margining-20230908.html

The cash-futures basis trade is an arbitrage trade that involves a short Treasury futures position (currently at record highs), a long Treasury cash position, and borrowing in the repo market to finance the trade and provide leverage. These are then delivered, and the position unwound, on expiry. The fact that the spike hit a level consistent with at the current Federal Reserve rate is suspicious at best and may in fact support a rapid deleveraging and Federal Reserve yield curve control to manage the situation.

The Fall of Rome

For anyone who doesn’t know about the current trend that ‘Real men think about the Fall of Rome every day’, have a look here Fall of the Roman Empire: Trend on TikTok exposes what men are really thinking | news.com.au — Australia’s leading news site. Like we’ve discussed before on Insights, sometimes you need to listen to what the whole community is telling you, and with a trend like this, there is certainly a growing ‘feeling’ in the broader community that something is not quite right.

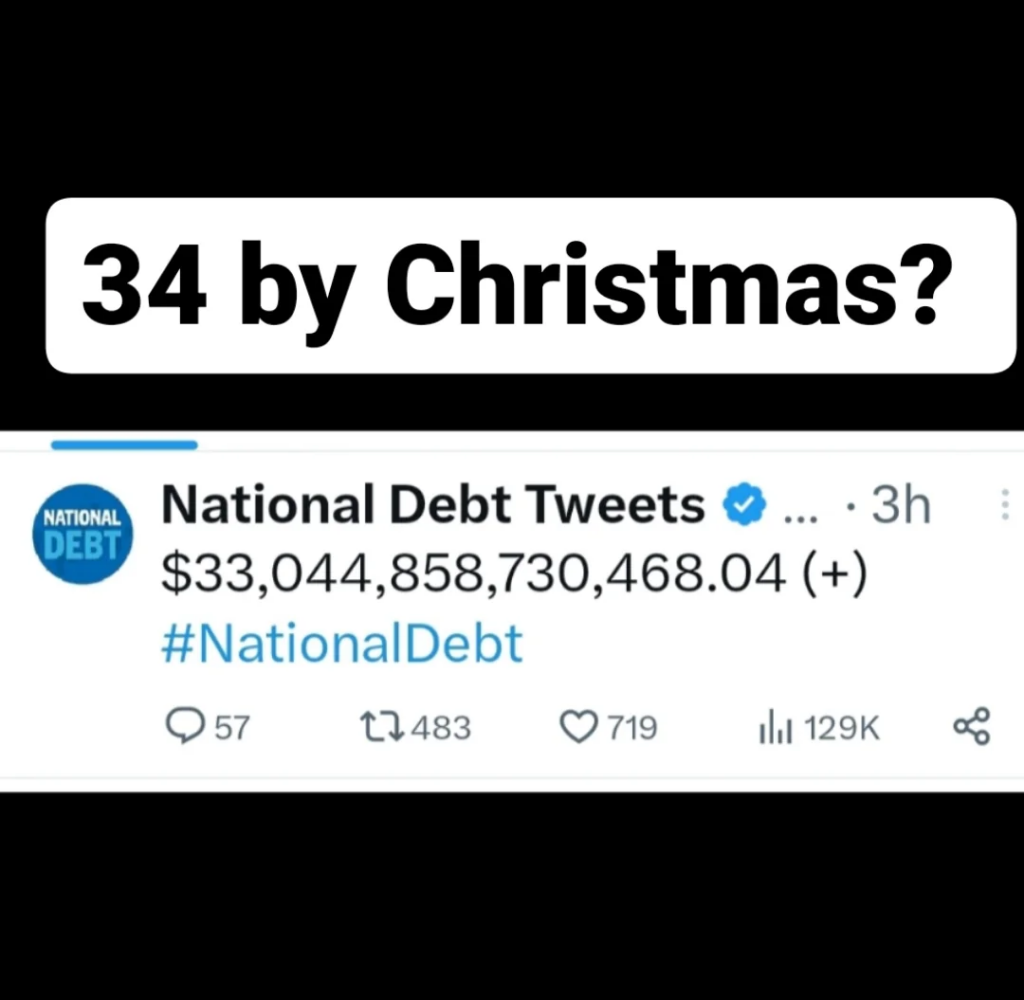

Whatever the cause of the ‘glitch’, volatility in bond markets is about to increase with the Federal Reserve September interest rate decision hitting headlines this week and if there are significant movements and repositioning going on in the background, we should expect more volatility and uncertainty in the markets. Could this have be the indicator that the inevitable credit event, ‘or the fall of Rome’ is about to happen?”