Title: Navigating Turbulent Waters: A Reflection on Current Economic Trends

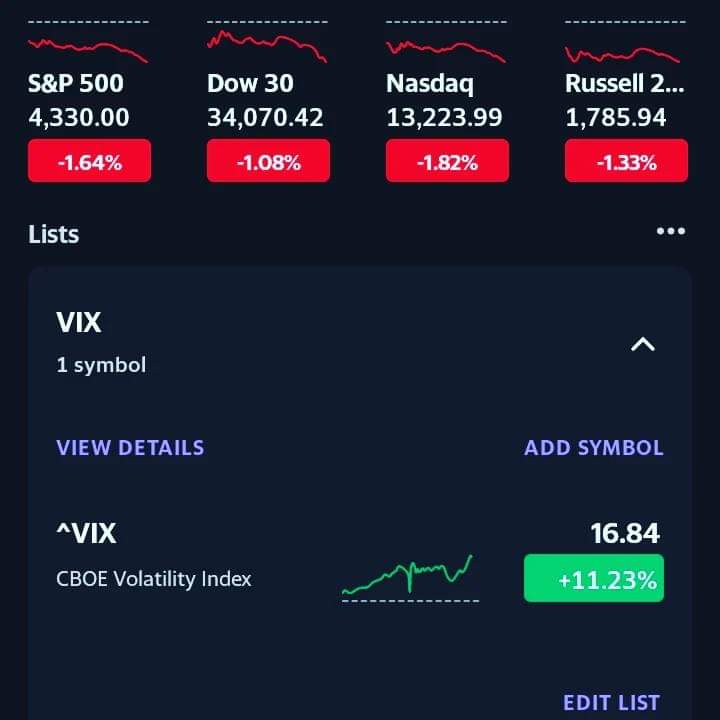

In the face of recent economic developments, it is crucial for us to remain vigilant and well-informed about the shifting landscape of financial markets. The past year has seen the US dollar currency index reaching a year-high, yet precious metals have continued their upward trajectory while oil prices have dipped below the $90 mark. These trends are indicative of a complex and ever-changing economic environment that demands our attention.Market equity indices have not fared well either, with many closing at their lowest points in recent memory. One noteworthy event was the nearly 2% drop on the NASDAQ, highlighting the volatility of holding risky tech stocks that are often influenced by underlying inflamentals with no basis in reality. Indeed, some profit projections seem absurd, business models flawed, and cryptocurrency holdings precarious. As we move forward, it’s likely that more turbulence awaits us, even affecting the Dow Jones Industrial Average.It’s not just in the United States that economic uncertainty looms large. Hyperinflation is rearing its head in various parts of the world, with Argentina experiencing triple-digit inflation and numerous other countries grappling with alarming rates. These inflationary pressures cast a shadow over the global financial landscape, highlighting the fragility of fiat currencies.In these uncertain times, many are left wondering where to safeguard their assets for future generations. The traditional wisdom of investing in hard assets appears to hold true, as they tend to weather economic storms more effectively. Real estate investing, once a stable choice, is facing headwinds due to rising interest rates. The Federal Reserve has made it clear that interest rates are unlikely to decrease anytime soon, keeping them at relatively high levels not seen in 15 years.The labor market is also experiencing its share of challenges, with United Auto Workers and Hollywood actors strikes marking the beginning of a concerning spike in joblessness. These events are a stark reminder of the broader economic implications that ripple through society.In the midst of this uncertainty, one thing is clear: we need to approach our financial decisions with caution and prudence. Gambling on cryptocurrencies and other volatile assets may not be the wisest strategy, given the potential for sudden bubbles to burst. It’s essential to take a long-term perspective and diversify our investments to mitigate risk.As we navigate these turbulent economic waters, it’s crucial to stay informed, seek expert advice, and make informed decisions that will protect our financial well-being and secure a stable future for generations to come. The challenges are substantial, but with resilience and careful planning, we can weather the storm and emerge stronger on the other side.