🌐”The recent developments within the BRICS alliance, consisting of Brazil, Russia, India, China, and South Africa, have the potential to reshape the world’s economic landscape.

While the American media has been preoccupied with domestic political matters, the BRICS group quietly welcomed six new members into its fold: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates.At the core of the BRICS agenda lies a bold aspiration—to challenge the longstanding dominance of the US in global politics and economics, particularly through its reserve currency status for the US dollar.

Brazilian President Luiz Inacio Lula de Silva has advocated for the creation of a new BRICS currency, and India is actively promoting the use of Indian rupees in trade with its partners, including Russia, instead of relying on the US dollar.

Moreover, there are reports of discussions among BRICS nations about the possibility of utilizing gold for international trade, diminishing their dependence on the dollar.

The roots of the dollar’s supremacy trace back to the early 1970s when President Richard Nixon severed its ties with gold. A pivotal moment came when Henry Kissinger orchestrated an agreement with Saudi Arabia, binding them to the dollar for international oil transactions in exchange for US support. This “petrodollar” arrangement has been instrumental in upholding the dollar’s reserve currency status. However, recent events are signaling potential cracks in this foundation. Earlier this year, Saudi Arabia struck a deal with Brazil to accept Brazil’s currency, bypassing the dollar for oil transactions.

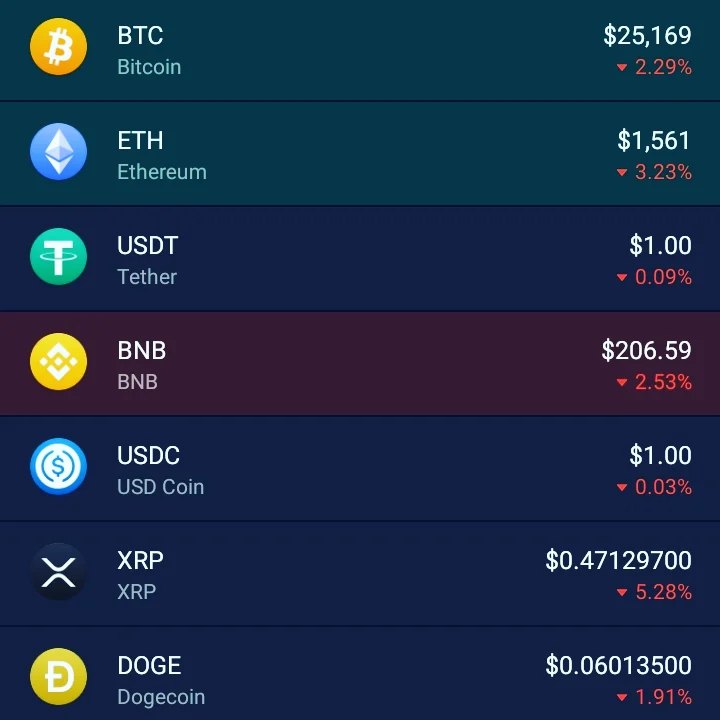

If similar agreements materialize with other BRICS nations, the dollar’s reign as a global reserve currency could face accelerated erosion.The move away from the dollar is also motivated by growing resentment over the perceived “weaponization” of its reserve currency status.

The US government has employed the dollar’s dominance as leverage to enforce sanctions on other countries, often forcing them into conflicts against their national interests. This heavy-handed approach has triggered a backlash, especially when the US insisted on international sanctions against Russia, regardless of the collateral damage to other economies.

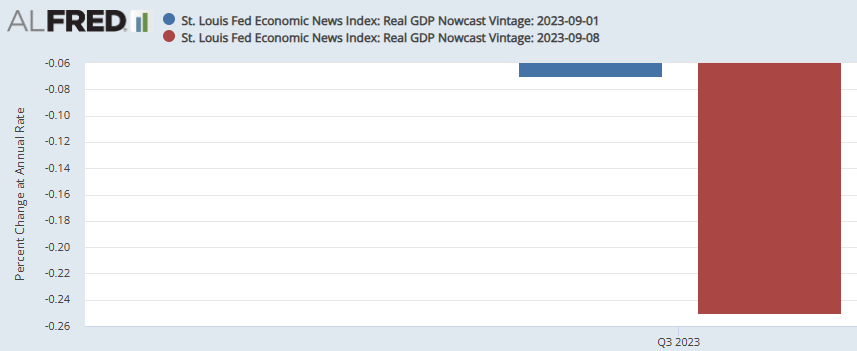

Another driving force behind the push to replace or diversify from the dollar is concern about the long-term implications of the colossal US national debt. Despite political claims of fiscal responsibility, the US’s $33 trillion debt is projected to balloon by an additional $115 trillion over the next three decades. Attempts to curtail spending seem elusive, even in areas where clear majorities of Americans oppose the allocation of funds, such as the ongoing Ukraine conflict.

Regrettably, it may require a shock like the rejection of the dollar’s reserve currency status, leading to a dollar crisis, to compel the US government and its citizens to confront their reliance on welfare-warfare spending and fiat currency. While this transition may entail challenging times, there is room for optimism. The crisis could serve as a catalyst for a return to a constitutionally limited government, a genuinely free-market economy devoid of corporate influence, a foreign policy centered on peace and open trade, and a monetary system based on market principles.#BRICS #Dollar #Economics #GlobalShift #MonetaryPolicy #ForeignPolicy