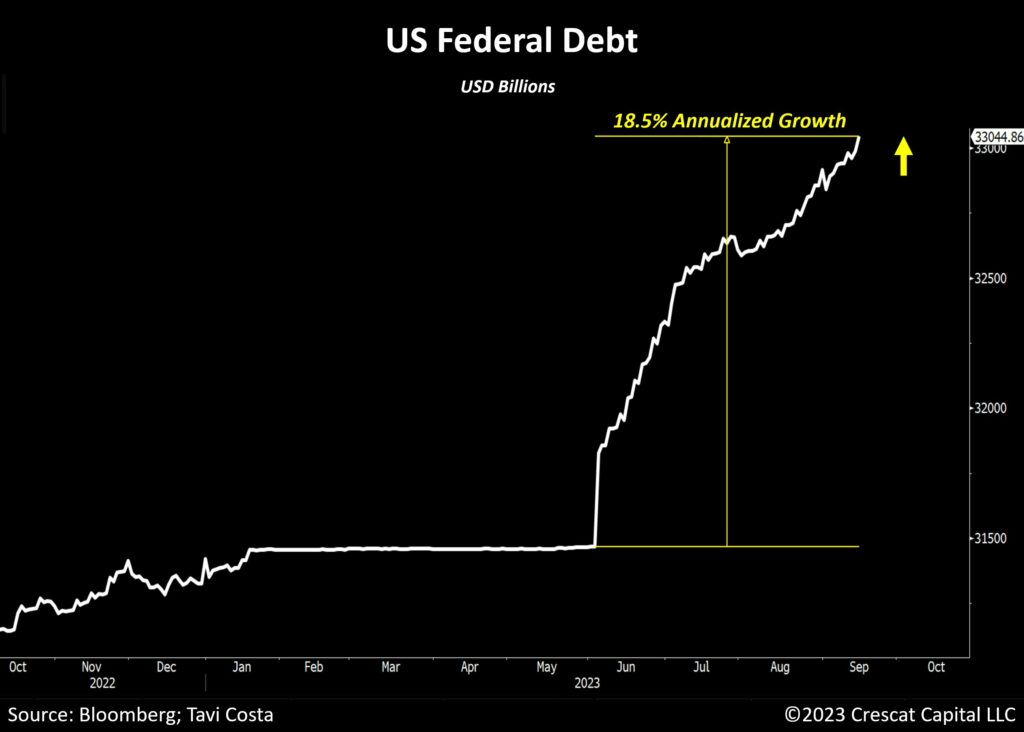

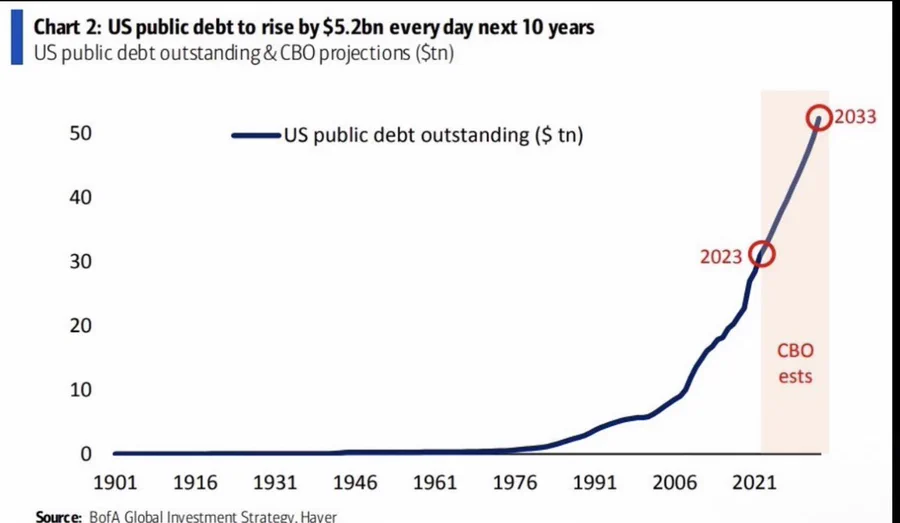

CBO projections show US Federal debt rising by $5.2 billion per day for the next 10 years. However, since the debt ceiling “crisis” came to an end, US debt has jumped by $30 billion per day. We have added roughly $1 trillion per month in US debt since then. Interest expense alone is on track to hit $3 billion per day. That means EVERY HOUR the US is borrowing $1.3 billion and paying $125 million in interest. What would happen if the US was a public company?

Title: “The Looming Crisis: America’s Debt Challenge and the Need for Change”

Introduction:

The United States is facing a growing financial crisis that threatens the very foundation of its future prosperity. The issue at hand? The ever-increasing national debt, which has reached alarming levels in recent years. Interest payments on this debt are now eclipsing even our defense spending, and it’s high time we take a closer look at this pressing concern. In this article, we’ll explore the concerning numbers, the implications, and the urgent need for a solution.

The Soaring Debt:

As of my last knowledge update in September 2021, the U.S. national debt stood at approximately $33 trillion. To put this staggering figure into perspective, just a year prior, on October 2nd of the previous year, it was “only” $31 trillion. That’s an alarming addition of $2 trillion in less than 12 months. To truly grasp the gravity of this situation, consider that it took 205 years from America’s birth in 1776 to accumulate the first trillion in sovereign debt, a milestone reached in 1981.

The Rapid Increase:

The situation has worsened with alarming speed. Between June 2nd and July 6th, the federal government’s borrowing increased by over one trillion dollars. On June 3rd alone, the national debt jumped by more than $350 billion in a single day. These numbers are unprecedented and should raise red flags for anyone concerned about the nation’s fiscal health.

The Consequences:

The consequences of this mounting debt are dire. With the debt service now exceeding defense spending for the first time in 30 years, we are left with an unsustainable financial burden. All too often, we hear about the pressing need for investments in infrastructure, education, and research and development. However, if we continue down this path, our interest payments will devour funds that could be used to strengthen these critical areas.

The Healthcare Connection:

A recent study by the Journal of Science estimated that up to 80% of healthcare costs occur during a patient’s final year of life. This is a concerning statistic, especially when coupled with the fact that healthcare spending has been a significant driver of our national debt. The more terminally ill our system becomes, the more expensive it is to maintain.

The Need for Change:

It’s worth noting that many of our political leaders are over 80 years old, and they are the ones making decisions that will impact the future generations. Selling our children into debt slavery to maintain the status quo is not the act of a responsible and caring society. We must question whether this is a sustainable path.

The Future:

The time has come for a serious reevaluation of our fiscal policies. We must consider the long-term consequences of our debt and make the tough decisions necessary to put our nation on a more sustainable path. What happens when the life support of excessive debt is inevitably taken off? It’s a question that demands our immediate attention.

Conclusion:

The United States is facing a debt crisis of monumental proportions, and it’s a challenge that can no longer be ignored. Interest payments are swallowing up resources that could be used for critical investments in our future. It’s time for a bipartisan effort to address this issue and secure a brighter financial future for generations to come. We must act now, before it’s too late.