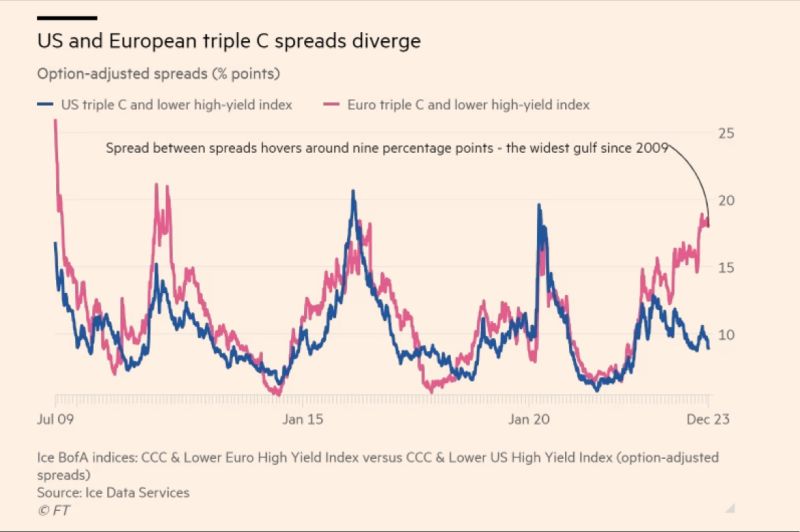

Credit spread with US triple C issuers is highest since 2009

A powerful rally in risky financial assets has left behind #Europe’s weakest corporate borrowers, with #recession fears persisting in the region just as optimism grows about a US “soft landing”.

Europe’s riskiest corporate #bonds now have an average yield of 19.66 per cent, according to an Ice BofA index tracking regional debt rated triple C and lower. That translates into a spread — the premium paid by companies over government debt issuers — of more than 18 percentage points.

By contrast, the lowest-rated US corporate bonds have an average yield of 13.47 per cent, with a much smaller spread of less than 9 percentage points. The difference between the two regions’ risky credit spreads this month has hovered at its widest level since the global financial crisis in 2009.

#investing#fixedincome#markets