Many have been asking, so for the next 30 days, for new yearly subscribers of our substack updates, we will send a signed copy of the book ‘Crypto Titans: How trillions were made and billions lost in the cryptocurrency markets” to their postal address (no extra shipping and handling fees).

👇 1) In our 2023 outlook report (published in December 2022), we had anticipated that Solana SOL could double in 2023 as we expected a solid crypto rally this year. SOL traded at $13, and the risk/reward seemed favorable. Indeed, SOL peaked in July at nearly $27.

Defi On Target is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.Subscribe

👇 2) As we warned last Tuesday, the FTX creditors could start selling $685m in SOL holdings, beginning this week – at least $3.4bn worth of crypto will FTX sell, which should remain an overhang for Altcoins for the rest of the year. During the last week, SOL declined by -6%.

👇 3) In anticipation of these sales, the SOL funding rate has turned negative (-14% annualized) and could decline further. Yesterday, we saw SOL breaking the $19 support with increasing volume. This is concerning; the more significant target levels are $15 and $10.

👇 4) Last Tuesday, we also warned about the upcoming ApeCoin unlocks, which will allow mostly insiders to sell another 11% of the outstanding tokens, or $50m (Saturday, Sep 16/17). During the last week, the ApeCoin declined by -10%.

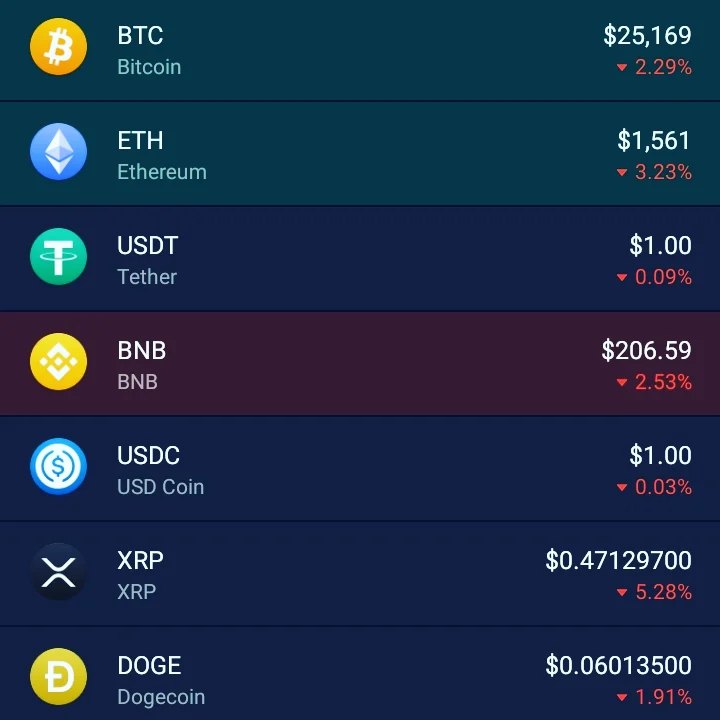

👇 5) Ethereum is also turning out not to be ‘ultrasound money’ as the issuance of 15k Ether is > 11k Ether being burned last week. We must monitor what this means (or if it matters). Still, with Ether being close to the psychologically important $1,600 level, a break could carry prices lower, especially as revenue growth disappoints.

👇 6) Technically, the break of $1,650 makes us extremely cautious Ether here and we could even envision a scenario where prices materially drop lower into year-end. A decline below $1,500 could bring back the idea that Ether could decline to $1,000 – a level that would appear justified based on the revenue projection from the Ethereum ecosystem (see our previous reports).

👇 7) Bitcoin price is 25,836 below the 50d MA 27,731 -> this is bearish, price WoW increased by -0.5%; Ethereum price is 1,617 below the 50d MA 1,752 -> this is bearish, price WoW increased by -1.1%; overall the trend is down -> bearish. Weekly BTC volumes have declined by -37%, while ETH volumes are down -31%. This low liquidity window could be prone to downside risk in prices.

👇 8) Ethereum currently underperforms Bitcoin as the trend (20d) MA shows ETH / BTC ratio is decreasing. Beta factors drive crypto; this is negative, so stay cautious. YtD, BTC has still outperformed the Nasdaq (+65% vs. +32%), but as all the BTC returns were generated in only three weeks this year, the BTC rally is more on shaky grounds.

👇 9) The futures funding rate trades positive for Bitcoin (3.6%), which is bullish, and the funding rate is positive for Ethereum (6.1%), which is bullish. But overall, the funding spreads are relatively moderate, especially for Altcoins, and we would not interpret this data as ‘bullish’.

👇 10) Our Greed & Fear Index prints 25%, while the Ethereum Greed & Fear Index prints 11%. The RSI for Bitcoin is 39%, while the Ethereum RSI is 36%.