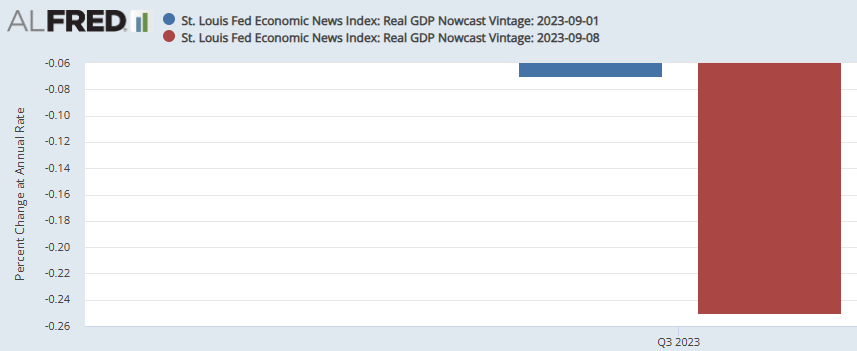

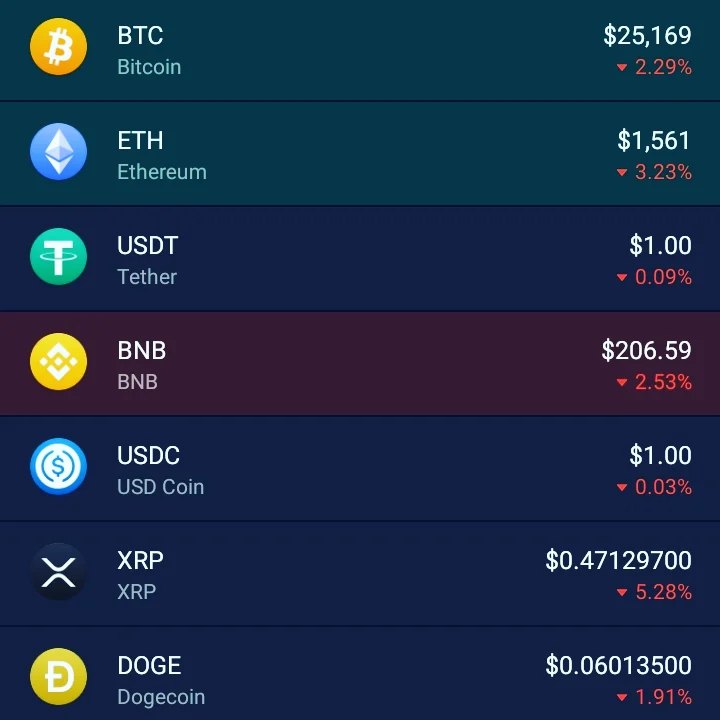

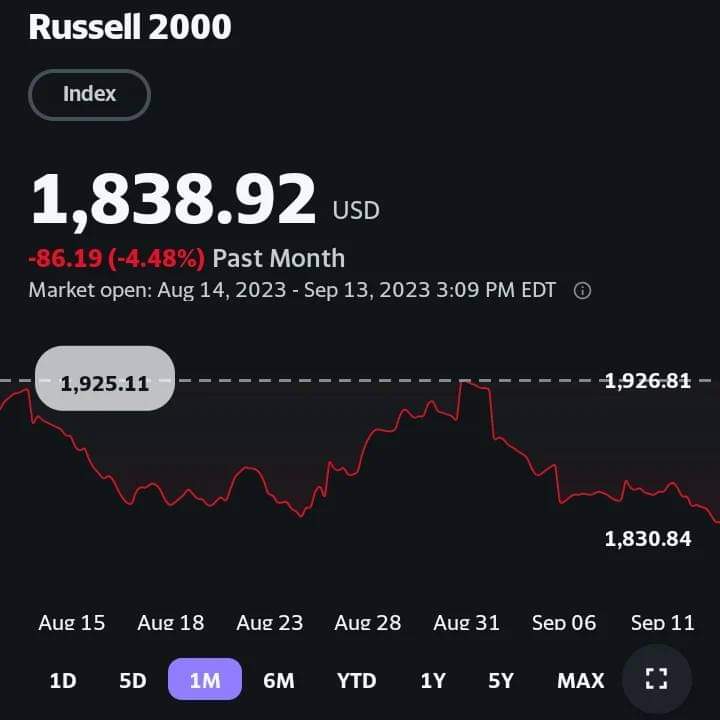

as I’m writing this update 20 minutes before the market closes, the Russell 2000 is down 0.9% and is dragging the Dow Jones Industrial Average down with it slightly. This leading indicator has now broken below the August Lowe’s. Markets are hard to keep on top of in this day and age because of the proliferation of so much information and data especially on a high news day like today. Oil prices surging to $89, and the CPI came in hotter than expected with many people expecting equities to keep running higher but it’s on borrowed time. The vix is currently under 14 meaning that many people are not proactively hedging with put positions on the CBOE volatility index S&P 500.

Title: “The Russell 2000: A Leading Indicator Sending Signals to the Markets”In the world of finance, sometimes it’s the smallest players that can signal big changes ahead. Case in point: the Russell 2000. This index, comprised of 2000 small-cap stocks, has recently broken below its August lows, and it’s sending a clear message that we all need to pay attention to.When the Russell 2000 takes a dip, it’s often seen as a leading indicator for broader market movements. The reason is simple: small-cap stocks tend to react more swiftly to changing economic conditions. So, when they start to stumble, it can be a sign of trouble ahead.What’s particularly concerning is the potential ripple effect. The Dow Jones Industrial Average and the S&P 500 may not be immune to the Russell 2000’s troubles. As the saying goes, “a rising tide lifts all boats,” and the reverse can be true as well. If small-cap stocks are struggling, it might not be long before larger players feel the pinch.Now, let’s talk about the beloved NASDAQ. This tech-heavy index has been riding high on an artificial intelligence tech rally, making it seem almost invincible. But remember, even the strongest can fall. While the NASDAQ might be the last to break, it’s not immune to market forces. When the tide turns, it could face its own challenges.Currently, the VIX, often referred to as the “fear gauge,” is trading at a low level of 13.75. This indicates that many investors aren’t expecting lower equity markets. But it’s worth remembering that markets can be unpredictable, and complacency can be dangerous.Inflation expectations are running high, and all eyes are on the Consumer Price Index (CPI) today. While everyone is focusing on inflation, the Russell 2000’s move below August lows serves as a reminder that markets can shift for various reasons. So, keep a close eye on these leading indicators and be prepared for the unexpected in today’s complex financial landscape.