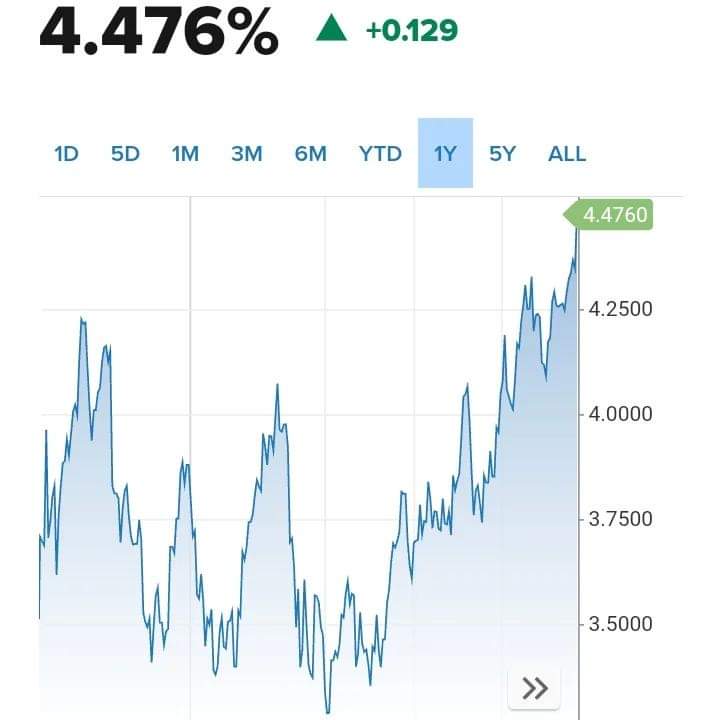

📈 U.S. Treasury Yields Surge to Multiyear Highs 📈As financial markets reacted to the Federal Reserve’s recent interest rate decision, forward guidance, and fresh unemployment data, U.S. Treasury yields continued their upward climb.🔼 The yield on the 10-year Treasury jumped by approximately 13 basis points, reaching 4.482%, marking its highest level since 2007.🔼 The 2-year Treasury also saw significant gains, rising more than 8 basis points to 5.197%, reminiscent of levels last witnessed in 2006.These yield highs coincided with the release of new U.S. unemployment data, with initial jobless claims coming in at an impressive 201,000, well below Dow Jones’ forecast of 225,000. This figure represents the lowest level since January.Market sentiment appeared to interpret this data as a signal that the Federal Reserve might need to further tighten its policy to combat inflationary pressures.📈 What’s Next for Rates? 📈During its September meeting, the Fed chose to keep rates unchanged, aligning with market expectations. However, policymakers hinted at another rate hike later this year and a commitment to maintaining higher rates for an extended period. Only two rate cuts are anticipated for 2024, down from the previously expected four in June.Fed Chair Jerome Powell emphasized the need for cautious monetary policy, underscoring the desire for more progress in the fight against inflation, despite some easing of pressures.In addition to rate decisions, the Fed released projections for key economic indicators, forecasting a 2.1% increase in GDP for the year, a substantial revision from earlier estimates.Furthermore, the core personal consumption expenditures price index, a gauge of inflation, is now expected to reach 3.7%, lower than initial predictions made in June.These developments underscore the dynamic nature of the economic landscape and the Federal Reserve’s commitment to steering the economy through challenging times.#Economy #FederalReserve #Inflation #TreasuryYields