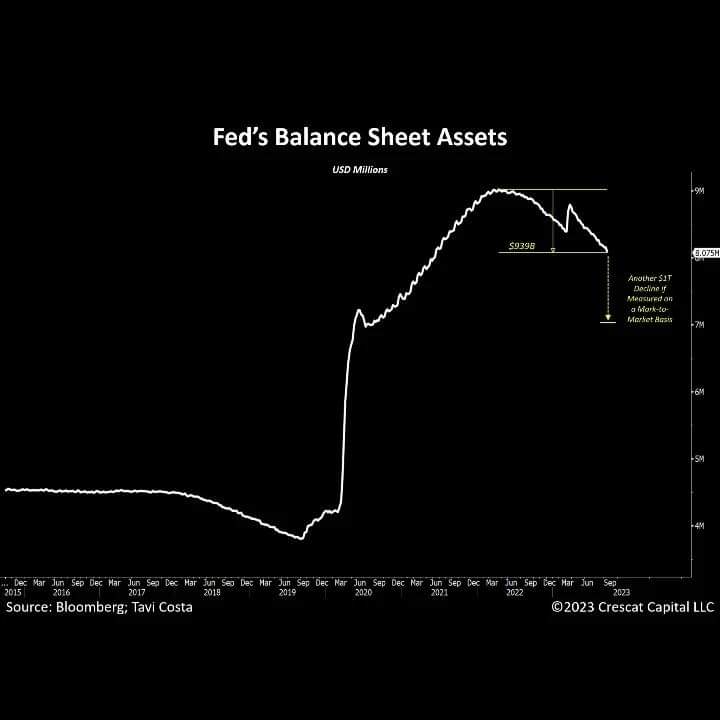

Treasury notes, bonds, and mortgage-back securities account for over 80% of the Federal Reserve’s balance sheet. Last week, the Fed’s #balancesheet plunged by almost $75BN last week, its biggest weekly drop since July 2020.The Fed’s balance sheet is now over 10% below its April 2022 peak. But this is WITHOUT taking into account the current drop in value of the #bonds held on the balance sheet. Indeed, if they were to be re-evaluated using a mark-to-market methodology, the Fed’s assets could be reduced by another $1 trillion. To provide some context, he recent decline in market value would likely exceed the entirety of their #QT policy thus far, which accounted for $939B. This would essentially revert their #balancesheet size back to 2020 levels.Source: Bloomberg, Tavi Costa