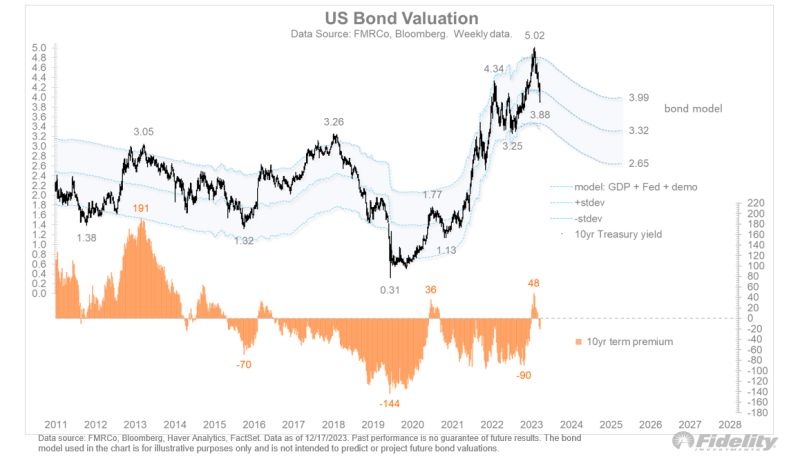

It’s a stunning reversal, from the top end of my bond model at 5% right through the middle at 4%, which my model calculates as fair value, based on potential GDP growth and the forward curve. The model shows 3.5% is the bottom of the range. (See chart titled “US Bond Valuation.”)

What’s next? My guess is that yields will meander between 4% and 5% in 2024, as ongoing questions about the emerging era of Fiscal Dominance weigh on the term premium. (See chart titled “Post-Pandemic Debt Dynamics.”) Next year’s election will likely be between two populists, and populists are not generally considered fiscal hawks. The forces that pushed the 10-year yield to 5% have not been repudiated by a soft landing.

The big question: Can we trust the Pivot Party that broke out last week when the Fed expressed sentiment for three rate cuts next year? My sense is that the Fed may have to eat its words at some point in 2024 and walk back from its pivot.

Even if the Fed sticks the landing, a premature pivot might reignite animal spirits enough (via a loosening of financial conditions) to prevent core inflation from falling further towards the Fed’s target zone. But that’s probably a story for the second half of next year.

For now, real rates have likely peaked, and that is welcome news for the markets.