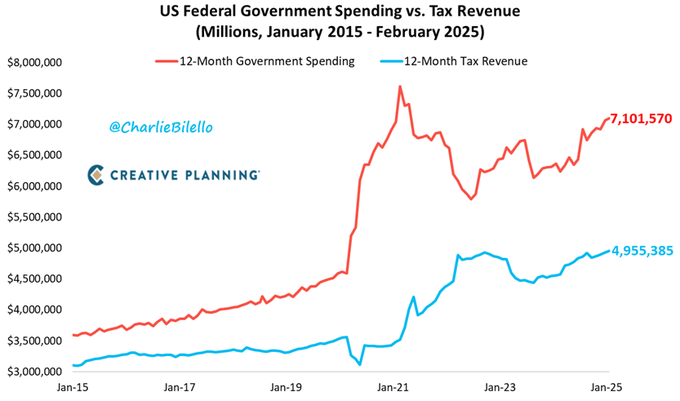

A major fiscal policy divergence is unfolding between Europe and the US

A major fiscal policy divergence is unfolding between Europe and the US. Europe is increasing government spending, while the US is moving toward austerity, largely influenced by declining Treasury yields. This is likely to drive a significant increase in interest rate differentials, making it fundamentally bullish for the euro against the US dollar.

2-year yields appear to be rolling over again,

2-year yields appear to be rolling over again, as we tend to see throughout history. This could mark the beginning of a major downward move in my view.

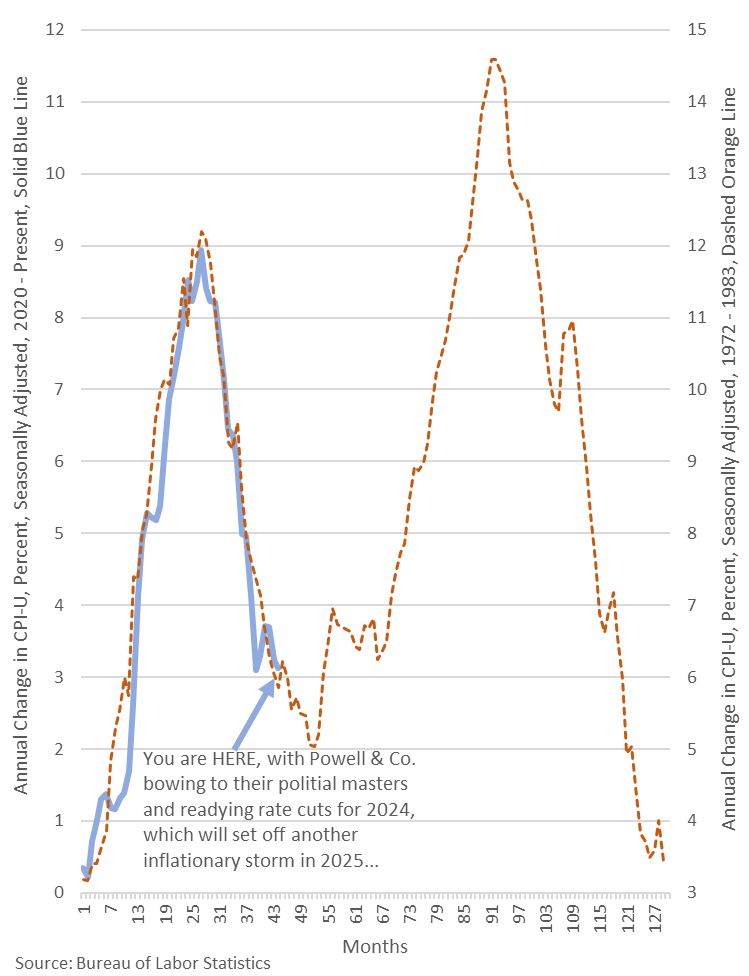

Is the #Fed making the same error as the mid 1970s?

In the 1970s they also thought they had beat #inflation in 1974-1975, they lowered #rates and then inflation roared back to even higher levels in the late 1970s. Inflation on came down in early 1980s because of two factors.1) massive new oil (energy) supply from Alaska, Gulf of Mexico, North Sea and huge new fields in Mexico coming online.2) …

Is the #Fed making the same error as the mid 1970s? Read More »