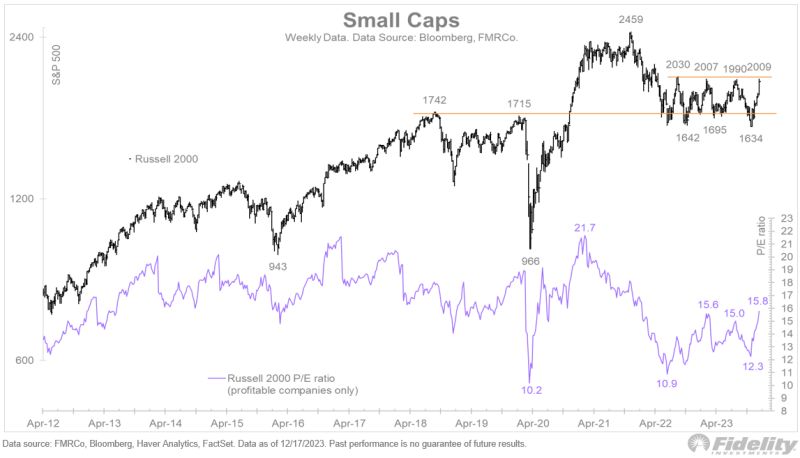

How hot has the stock market been recently? Even the lowly Russell 2000 index has traversed back to its range highs, although it remains some distance from its all-time highs. The “Everything Rally” has brought even the small caps to the party.

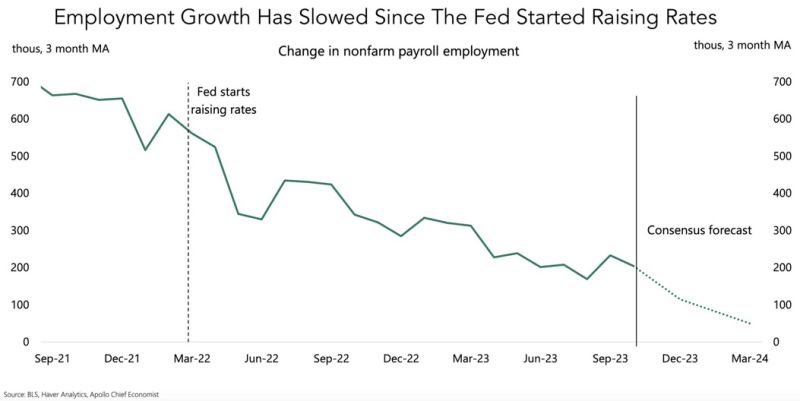

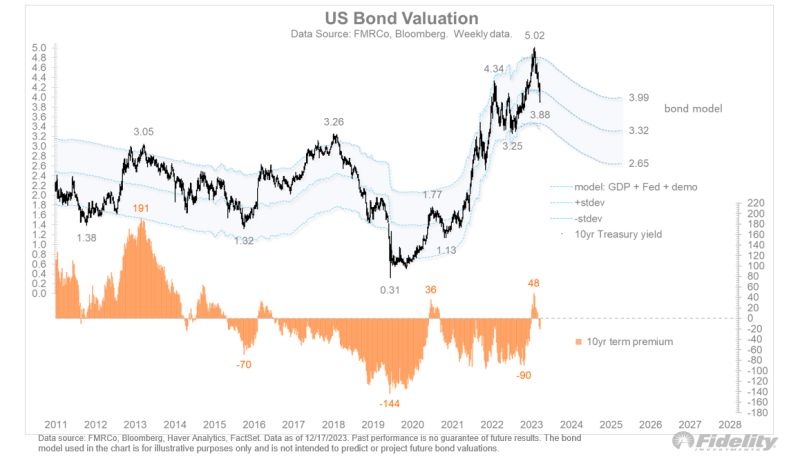

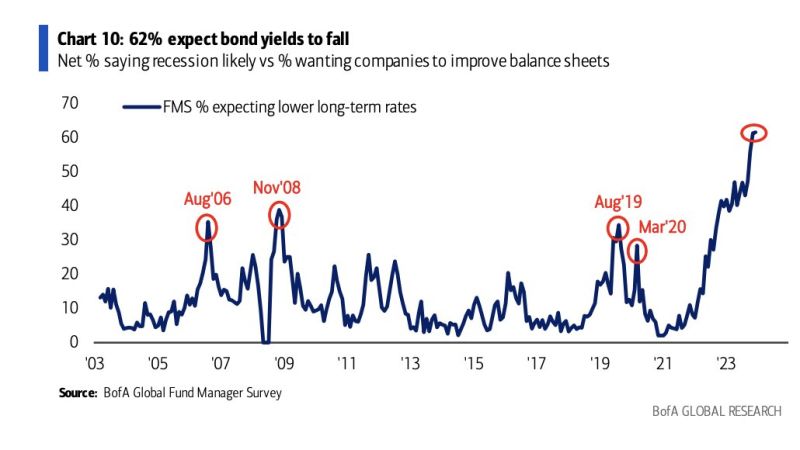

Part of the reason is improving liquidity, a surprise trend, despite the Fed’s ongoing Quantitative Tightening (See chart titled “Overall Liquidity.”). However, the biggest reason is this: The stock market is having itself a Pivot Party. After a long hawkish campaign, the Fed pulled an about-face last week and hinted that rate cuts are next, starting …