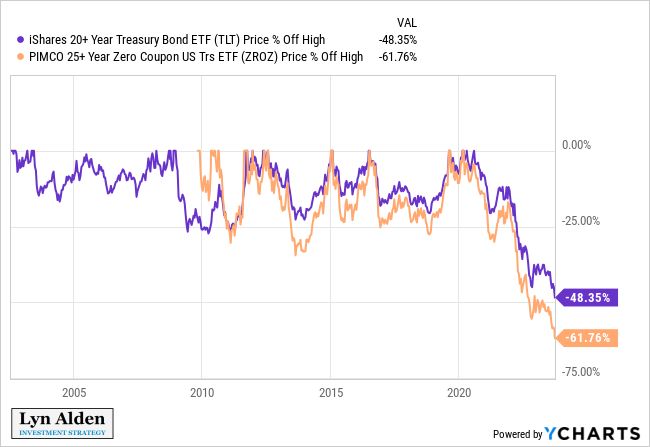

It Will Take A 30-40% Market Drawdown Before The Fed Pivots

Monetary expert Matthew Piepenburg of GoldSwitzerland.com returns for Part 2 of our interview with him in which he explains why, whenever countries become too indebted (as we are now) it’s ALWAYS the currency that’s sacrificed. In the long run, hyperinflation is likely to be the end result. But in the near term, a recession & …

It Will Take A 30-40% Market Drawdown Before The Fed Pivots Read More »

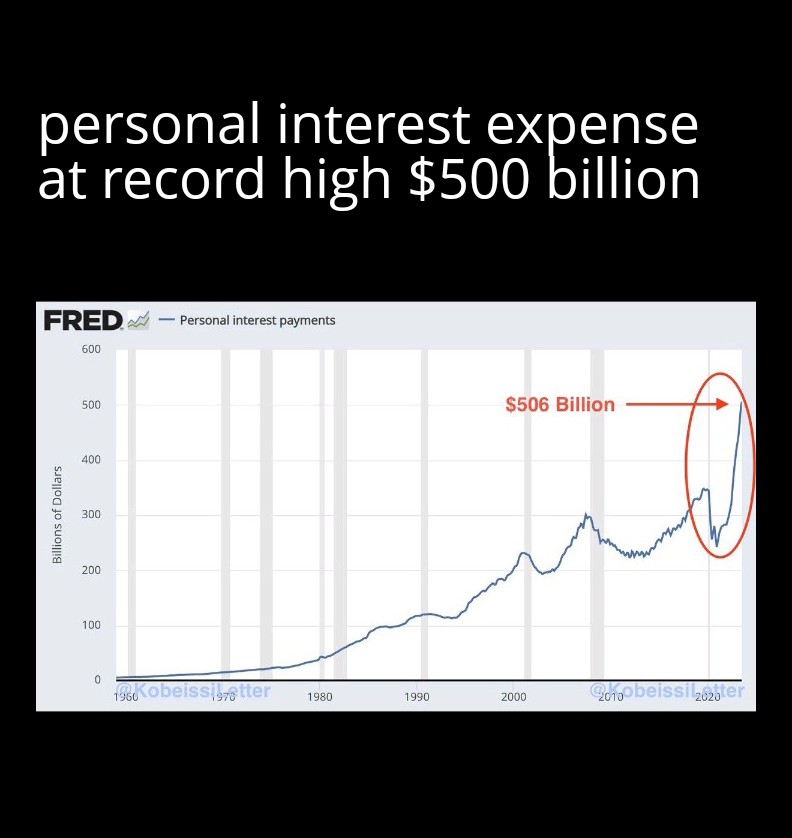

JUST IN: Personal interest payments in the US hit a record $506 BILLION in July.

JUST IN: Personal interest payments in the US hit a record $506 BILLION in July.During the first 7 months of 2023, Americans paid a total of $3.3 TRILLION in personal interest.This is up a staggering 80% since 2021 and nearly above the entire 2022 total.The worst part?These numbers do NOT include interest on mortgage payments.Source: …

JUST IN: Personal interest payments in the US hit a record $506 BILLION in July. Read More »

Taxes, Taxes, Taxes

When you get a paycheck they take out the income taxes right away. When you buy groceries or clothes you pay sales tax. The house you live you have to pay property taxes so you can keep it. When you park your car you have to pay a fee to use the parking spot that …