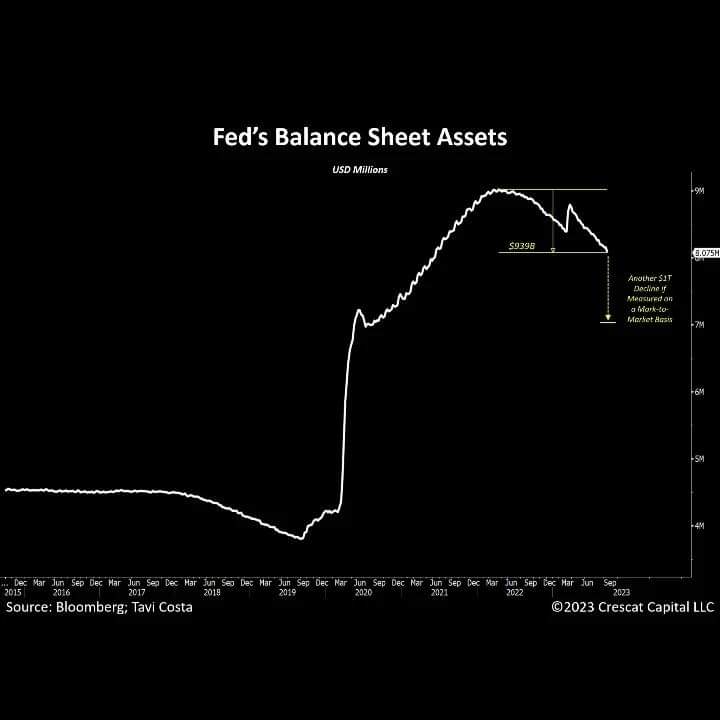

Last week, the Fed’s #balancesheet plunged by almost $75BN last week, its biggest weekly drop since July 2020.

Treasury notes, bonds, and mortgage-back securities account for over 80% of the Federal Reserve’s balance sheet. Last week, the Fed’s #balancesheet plunged by almost $75BN last week, its biggest weekly drop since July 2020.The Fed’s balance sheet is now over 10% below its April 2022 peak. But this is WITHOUT taking into account the current …