Uncategorized

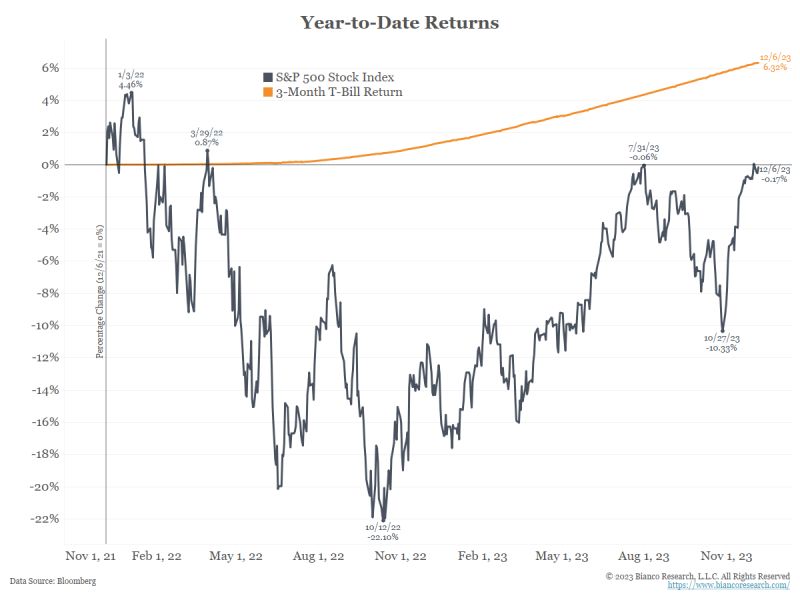

Regarding the stock market, the S&P 500 is exactly at the same level it was two years ago today, December 6, 2021. As the black line shows, the change in the index is up just 0.17%.

Orange is the 3-month T-Bill over the same period, up 6.3%.

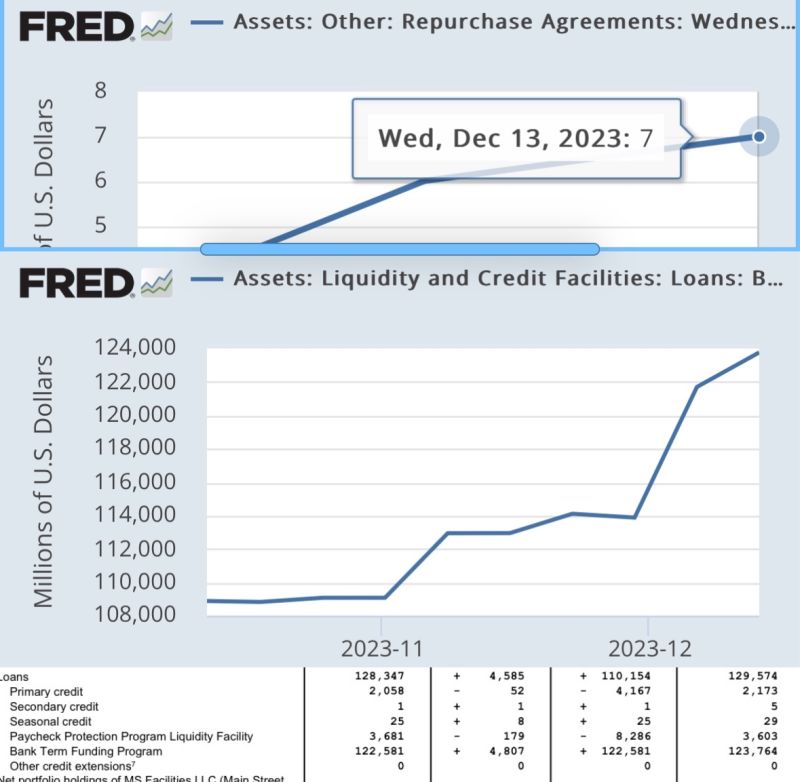

💵 The Fed is injecting liquidity into the market through various facilities , raising concerns

📈 BTFP reaches a new record high, signaling heightened worries for banks 🔄 Repo 🖨️💵 on the rise, indicating stress in the financial plumbing.