🚨 BREAKING: Wall Street’s new target? ESG stocks. They’re shorting them big time. But why?

🕵️♂️ Hedge funds are exposing fake green promises and inflated values pumped up by stimulus. 📉 And guess what? Big players like Blackrock & State Street are pulling the plug on some ESG funds. 🔄 Talk about a 180! Just last year, ESG-themed assets were soaring to new heights. 📢 Current scene? 🚪 ESG fund …

Shorting APPLE APPL, AND A 7% FED FUNDS RATE

I know it is heresy to short the Bank of Apple (AAPL) at 179-180 but that is exactly what I mused about on Monday morning. AAPL is now mauled by Mr. Market to 169.80 and my target to cover remains 158-160. AAPL is a cult headed by King Cook but no EPS growth, slowing services/software …

Doug Casey on the Silent Depression and Current Economic Realities

International Man: Wall Street Silver, a financial analyst on Twitter, highlights that during the Great Depression, the average home cost 3x the average income. Today, it costs 8x as much.In the 1930s, the average car cost about 46% of a year’s earnings. Today, they eat up 85% of the annual average wage.Rent, which previously claimed …

Doug Casey on the Silent Depression and Current Economic Realities Read More »

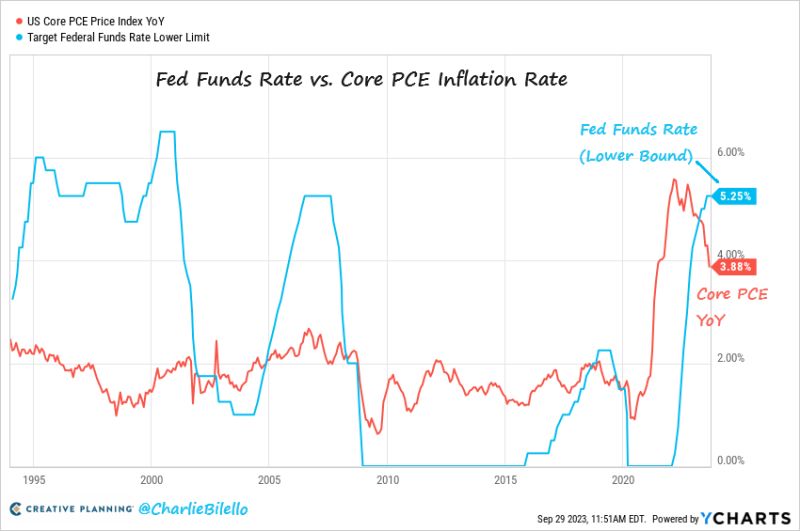

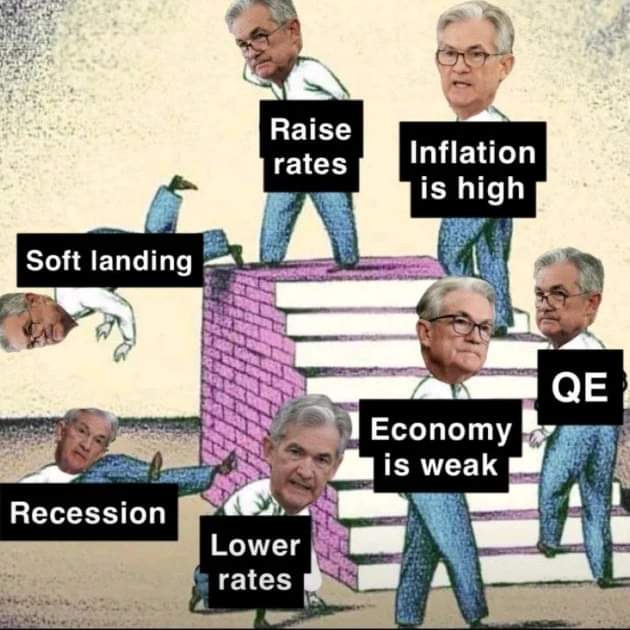

Is the market losing faith in the Fed again?

The S&P 500 is now down 340 points, or 7.5%, since the Fed removed a recession from their forecast. On July 26th, the Fed raised rates and said they were not longer expecting a recession. The Fed marked the EXACT high in the S&P 500 which just hit its lowest levels since June. Since then, …

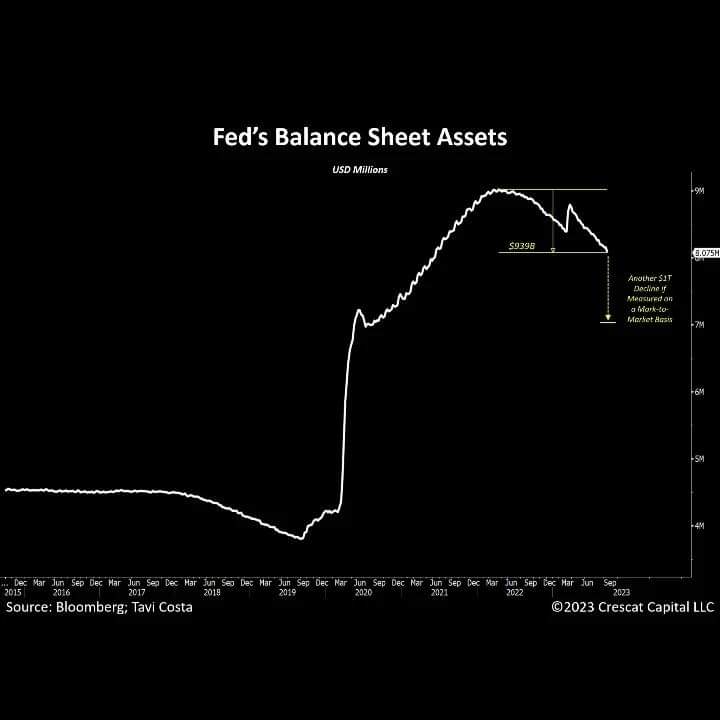

Last week, the Fed’s #balancesheet plunged by almost $75BN last week, its biggest weekly drop since July 2020.

Treasury notes, bonds, and mortgage-back securities account for over 80% of the Federal Reserve’s balance sheet. Last week, the Fed’s #balancesheet plunged by almost $75BN last week, its biggest weekly drop since July 2020.The Fed’s balance sheet is now over 10% below its April 2022 peak. But this is WITHOUT taking into account the current …

capital consistently flows into the $TLT ETF despite a nearly 50% drop in its underlying price.

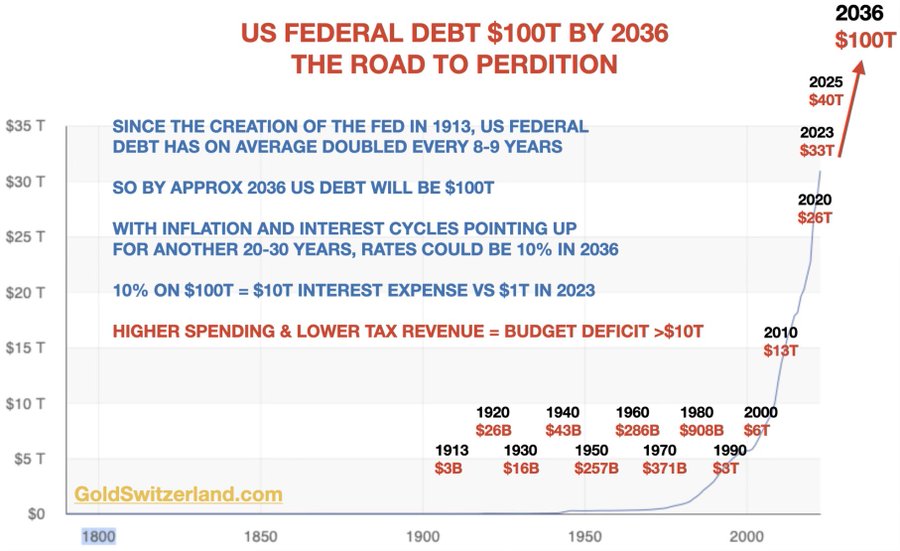

“Investors continue to desperately pour money into Treasuries despite the massive underperformance. Note how capital consistently flows into the $TLT ETF despite a nearly 50% drop in its underlying price. 60/40 portfolios continue to stubbornly allocate funds to this underperforming asset, hoping for a return to a disinflationary environment. We are currently experiencing a significant …