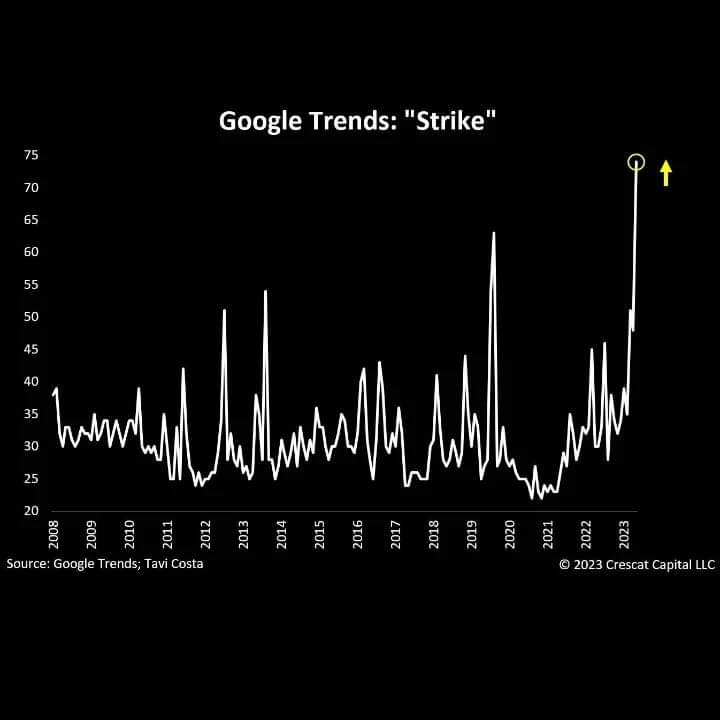

“STRIKE” TRENDS

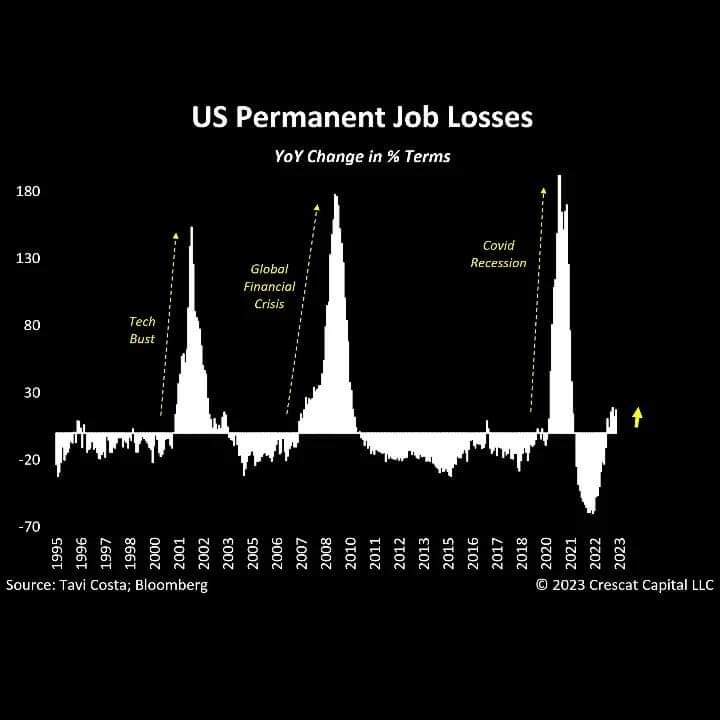

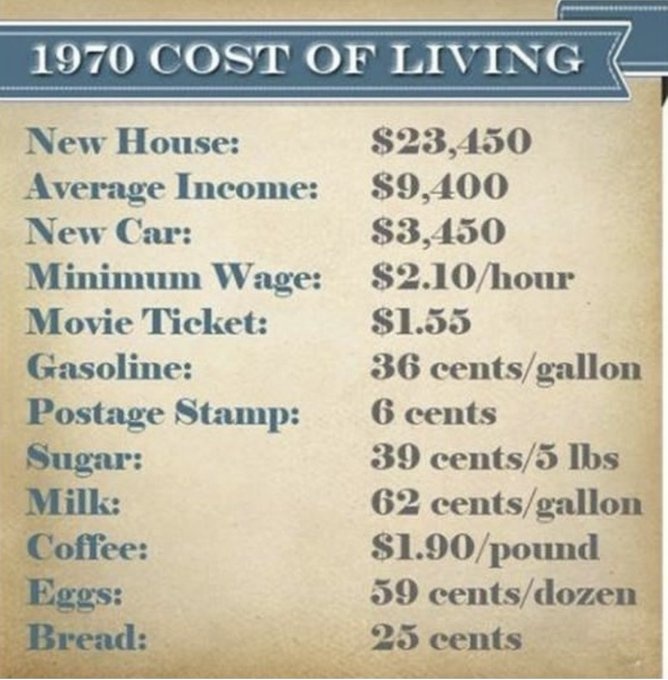

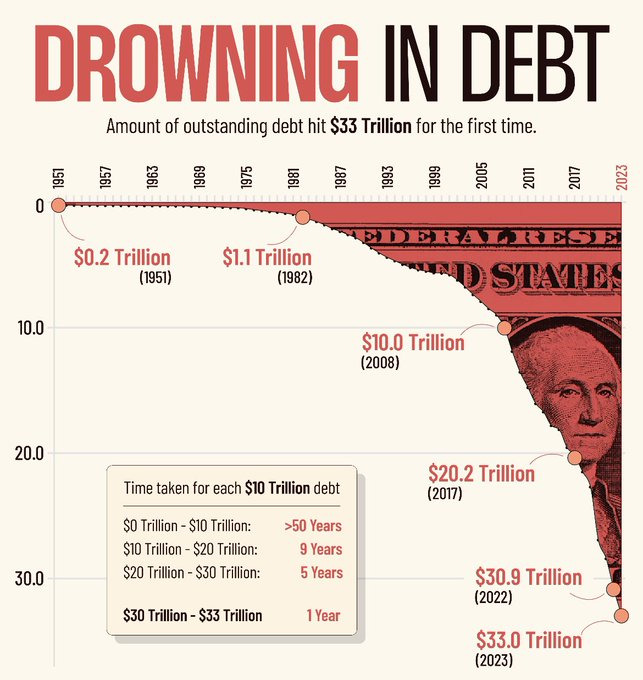

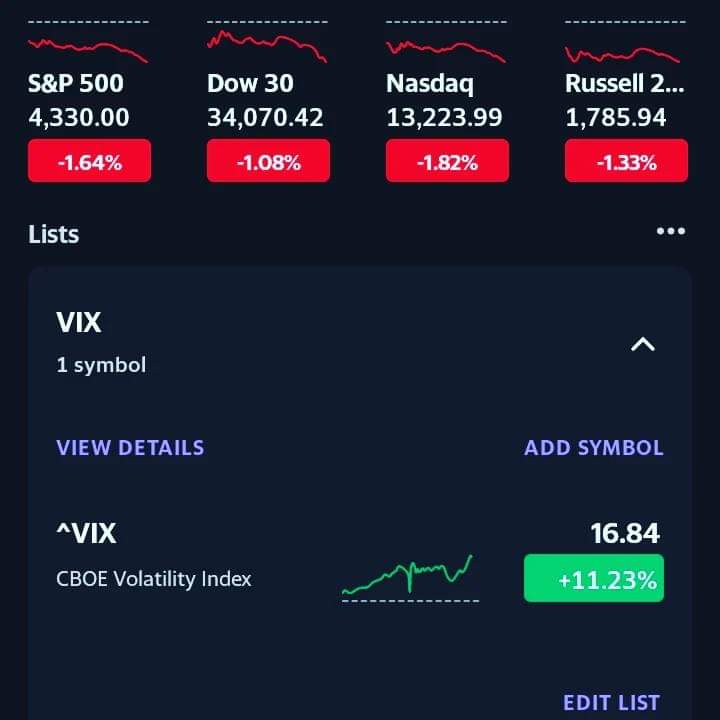

As someone who avidly reads newspapers, if you believe that a labor strike involving thousands of auto workers is just an isolated event, you are overlooking the bigger picture.It’s actually a much larger and more complex issue, deeply rooted in a structural inflationary context.Wage pressure primarily stems from the increased cost of living, and developed …